Including ESG KPIs in quarterly or semi-annual reports shows that ESG strategy management is sound, transparent, and consistent. Here are some options and tips.

KPIs (Key Performance Indicators) are essential parameters for monitoring the achievement of goals and the evolution of the performance of any organisation. They are instruments used to monitor the company’s performance as well as achieving success and growth in a sustainable manner. In this article we will discuss ESG metrics or KPIs to exemplify how to incorporate them into your strategy.

What is ESG investing, otherwise known as SRI?

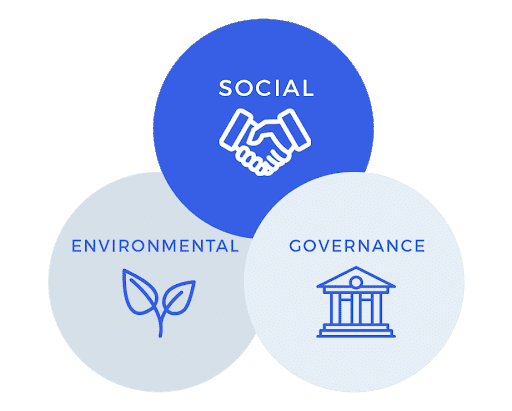

Environmental, Social and Governance (ESG) is an investment discipline that takes into account criteria based on environmental and social sustainability as well as good corporate governance.

Today, socially responsible investing (SRI) has taken centre stage among investors and managers.

Sustainable investing has seen rapid growth within the asset management industry. Investing sustainably means including non-financial aspects in investment decision-making. On a daily basis, investors throughout Latin America and across the world are demanding more ESG information.

What are the ESG criteria?

The ESG criteria cover three aspects:

- Environmental care: focuses on decision-making based on how company activities affect the environment. For example, greenhouse gas emissions, waste treatment, pollution, among others.

- Social: factor that values the way the company deals with people. In other words, it focuses on the working conditions of employees, diversity, equal opportunities, treatment of customers and suppliers, among other aspects. These factors impact the community in relation to the activities developed by the organisation.

- Corporate governance: analyses the impact of the company’s own shareholders and management. It has a focus on board structure, shareholder rights, and transparency.

These three criteria are key factors when making an ethical and responsible investment, in which quality indicators of companies and corporate responsibility to society or the community are worked on.

ESG KPIs within your business strategy How do you include them in your reporting?

Investors are increasingly interested in investments that reflect their personal values, so accessing ESG investments can increase the engagement of all investors and partners.

Including ESG KPIs in quarterly or semi-annual reports shows that ESG strategy management is sound, transparent, and consistent. Here are several options to add this information to your report and analysis:

- Organisation and planning: create specific checklists by type of engagement and recipient; you can also connect multi-format documents for each engagement registered. At Datamine, we have Environmental Commitment Management modules that facilitate this task.

- Constant and remote review: monitors the status of each registrant’s commitments globally and in detail.

- Record of activities: records in detail each of the commitments and assigns those responsible for the execution of compliance tasks. This analyses if new projects were launched and if there were results of materiality analysis.

ESG reporting should be concise and clear, and always define and share your objectives with investors.

Within the ESG KPIs you must favour the understanding of the error and success of the organisation, in addition to providing the possibility of applying corrective actions in the event of a possible deviation from the objectives of an organisation. Having a system to control and monitor the actions launched and the work performed will help to develop and improve business decision-making.

The most common indicators to publish in an ESG report are all issues related to materiality, but you can also include information related to climate change. While there is no general rule on which ESG KPIs to add to your report, in general, these two points can give you an idea.

Datamine software solutions allows you to manage all your ESG KPIs in a comprehensive and efficient way, thanks to its customisable modules and 10 years of experience that guarantee the quality of all our services.

Contact us, and request a Free DEMO here of our Software to manage ESG KPIs in your organisation.